No Legal Means for Trading Alt Coin CryptoCurrency

No Legal Means for Trading Alt Coin CryptoCurrency: As a result of our research, and my subsequent personal musings about regulation 12(g), it has been concluded by our counsel, in conjunction with the senior securities partner at Pillsbury Winthrop Shaw Pittman in NYC, that at present, there are no legal means for trading altcoin cryptocurrency issued through ICO by non-accredited US citizens.

We have confirmed with the SEC Office of Chief Counsel they don’t care about the nature of the security under Reg A, whether equity or debt instrument. Which is good, because that alleviated one of my biggest concerns. A company can indeed be compliant by issuing under 506(c) and Reg A.

But since the SEC is leaning towards all ICOs as being securities, even a Reg A tier 2 registration doesn’t clear the path for companies wanting to be regulatory compliant when it comes to an actual trading of the tokens.

No Legal Means for Trading Alt Coin CryptoCurrency

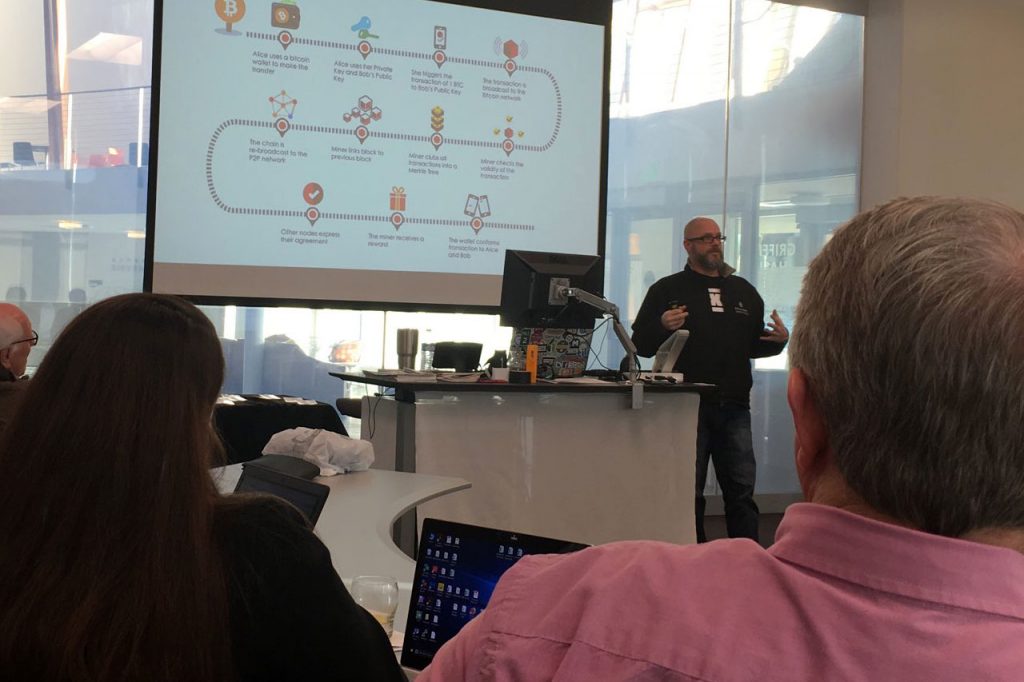

12(g) requires a transfer agent. Period. No exchange or trading platform, nor personal direct transmission of an alt issued by ICO is currently registered as or engages a transfer agent in blockchain land. While the function of a transfer agent is partially handled through the transaction recording on the blockchain, the blockchain by itself is not sufficient to fully replace the transfer agent function in and of itself without additional metadata and reporting.

We are engaging the Office of Chief Counsel and submitting a joint whitepaper to petition them for an exemption status to allow 10XTS to become the first fully-compliant blockchain DLT framework that replaces the transfer agent requirement under US securities laws.

They are very receptive to the argument but would require us to present to the Chief Counsel for full determination and ruling.

In the event we are successful, it would put 10XTS in the pole position for all ICO-issued alt trading and reporting.

1 Trackback / Pingback